Don HUANG

This template doesn't support hiding the navigation bar.

Research Project 1:

AI Macro Quantitative Allocation Model|High Win Rate · Robust Risk Control

Overview

- Developed by AQUMON, AI Macro leverages advanced AI technology to interpret markets through synthesized macro indicators. It processes macroeconomic data to deliver timely analysis and short-term forecasts, constructs distinct macro regimes, and integrates a wide range of signals—including macro regime, price-to-earnings ratio (PE), profitability, leverage, bond yield spread, and credit spread. Based on this, it generates 5 levels of allocation views (Positive / Moderately Positive / Neutral / Moderately Negative / Negative). The allocation views reflect a forecast for the next 3 months.

- Covering both international and domestic markets with a focus on global allocation, AI Macro dynamically adjusts asset class weights to outperform traditional 60/40 or static all-weather strategies.

- AI Macro allocates across equities and fixed income in four regions: China, the US, Europe, and Japan:

- Identifies each region’s macro regime based on economic and risk appetite indicators synthesized from multiple data points.

- Integrates macro regime, valuation, fundamentals, and spreads to derive a five-level allocation view.

- Final portfolio weights are determined based on benchmark weights adjusted by the model's view: Overweight / Slightly Overweight / Neutral / Slightly Underweight / Underweight.

Key Advantages

✅ High Win Rate + Attractive Risk-Reward

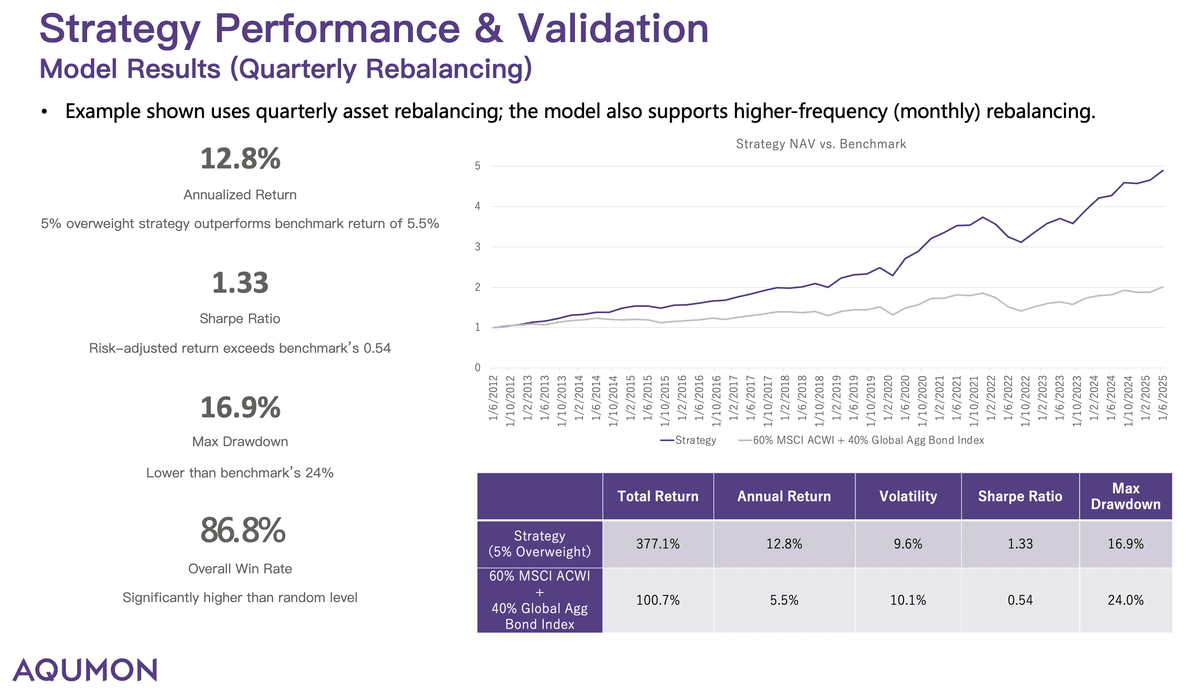

- Backtested win rate of 78% (above 50% is considered strong); risk-reward ratio of 1.85 (above 1 is excellent)

- Sharpe ratio of 0.74, outperforming the benchmark (0.58); maximum drawdown of -18.4%, better than the benchmark’s -20.2%

- Very low misallocation risk: just 2.6% overweight produced 22.5% excess return

✅ Rational & Contrarian Decision-Making

- Accurately bottomed US equities during the COVID crash in April 2020

- Remained bullish on the S&P 500 at the end of 2022 despite widespread pessimism over rate hikes, capturing the next rally early

✅ Diversified Allocation, Controlled Volatility

- During the 2020 global equity sell-off, the strategy’s drawdown was just -10.3%, half that of the S&P 500 (-20.4%)

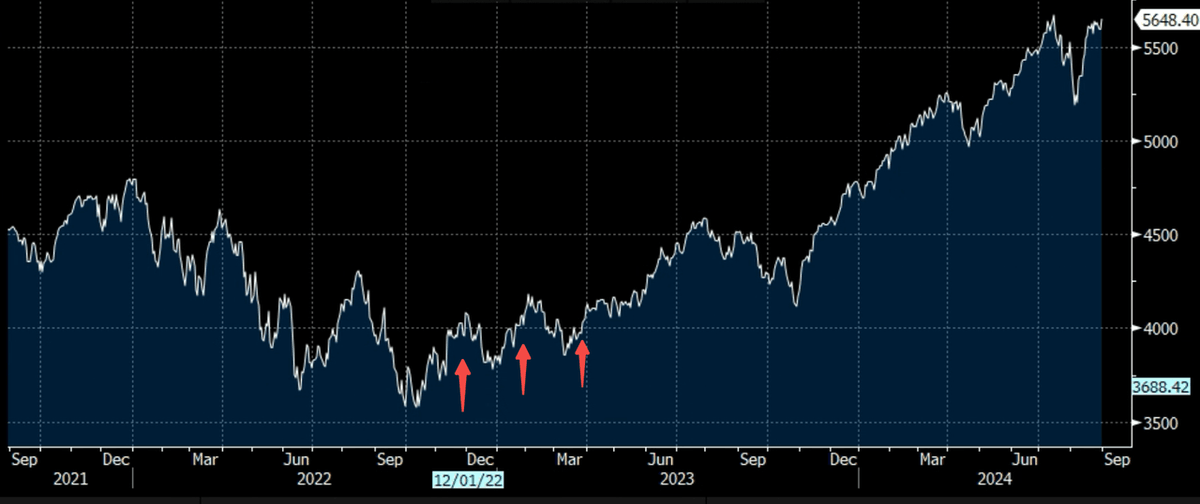

Model-Driven Rationality Outperforms Emotional Bias

The model issued bottom-fishing signals following two major US equity drawdowns in recent years:

- Case 1: In April 2020, after the COVID-driven crash, the model signaled bullish on the S&P 500 just as markets stabilized—avoiding panic and identifying the rebound early.

- Case 2: In late 2022, amidst negative sentiment from Fed rate hikes, the model repeatedly issued overweight signals on the S&P 500, capturing the next leg of the rally.

Research Project 2:

AI China Alpha Strategy - Machine Learning based Factors Investment

Research Project 3:

Central Bank Policy Sentiment Detection

Research Project 4:

AI-driven Risk Evaluation and Monitoring

Copyright 2018